Ready to buy a house? Before you shop for a home, consider shopping around for…

Why Your Debt-to-Income Ratio is Important

As you go through the process of researching mortgages, the phrase “debt to income ratio (DTI)” will frequently appear as part of what lenders consider when evaluating borrowers. To qualify for the best loan terms, you need to have an understanding of what your debt to income ratio is, why it’s important, and what you can do to improve it.

What Is Debt-to-Income (DTI)?

Simply put, your DTI is how much debt you have versus how much you make each month. To calculate your DTI ratio, add up all the payments you make toward your debt over the month. This amount should include monthly credit card payments, car loans, student loans, alimony, or any other kind of debt you are paying off. It does not include expenses such as rent, grocery bills, and utilities. Next, divide your monthly debt payments by your monthly gross income (how much you make before taxes). Once you do this, multiply by 100 so you can see your percentage.

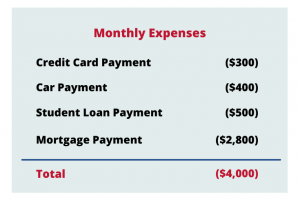

For example, if you pay $300 a month for your credit card minimum, $400 in car payments, $500 in student loans, and will pay $2,800 a month for the mortgage amount you want, your debt is $4,000.

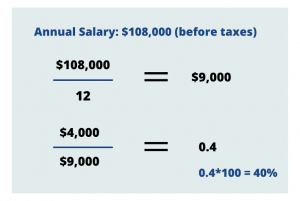

Now take your annual salary of $108,000 before taxes and divide it by twelve. This gives you $9,000 a month. Divide 4,000 by 9,000 and you’ll get 0.4. Multiply this by 100 and you have your DTI of 40%.

Why Does It Matter?

DTI matters because lenders use it, among other things, to decide how much you can borrow, what kind of loan you can get, and if you even qualify for a mortgage. The amount you’ll be able to afford relies heavily on the health of your DTI.

Lenders vary on what percentage of DTI they will accept for a mortgage, but the range is between 36% to 50%. DTI that is 36% or lower is considered excellent, 43% is good, and 50% is the maximum you want to have. Those in the higher DTI range may only qualify for loans like a Fannie-Mae or Freddie-Mac, where you’ll be obligated to pay a monthly mortgage interest for the life of the loan. For VA loans no maximum DTI is specified, though VA loan applicants with higher DTIs could be subject to additional scrutiny.

What Can I Do To Improve My DTI?

To get a healthier DTI start with these 3 things:

- Lower Your Monthly Debt Obligations. In the months leading up to your loan application make debt payment a priority. Consider putting some retirement or other savings on hold temporarily to make larger payments toward your debt.

- Pay Down Your Credit Cards. Start prioritizing paying off your credit card debt. Try to make more than the minimum monthly payment. Don’t close any cards, though, as it will negatively affect your credit score.

- Don’t take out any new loans before buying a house. If you want to buy a home, this is not the year to purchase a new car or take out a personal loan. Avoid any large purchases that require you to go into debt.

We Can Help

We know what it takes to qualify for a loan, and what kind of loan would be best for your situation. If you have any questions about the process or how to put yourself in the best financial position possible, call us at 844-6-VA-LOAN or email us at info@txvamtg.com.